26 August 2021

For www.Zoopla.co.uk

There is a shortage of homes for sale, with the number of property listings dropping to the lowest levels since our records began.

There is an acute shortage of homes for sale, with the supply of listed properties failing to keep pace with the recent buying frenzy.

The competition for limited homes on the market is pushing house prices up, according to our latest UK House Price Index

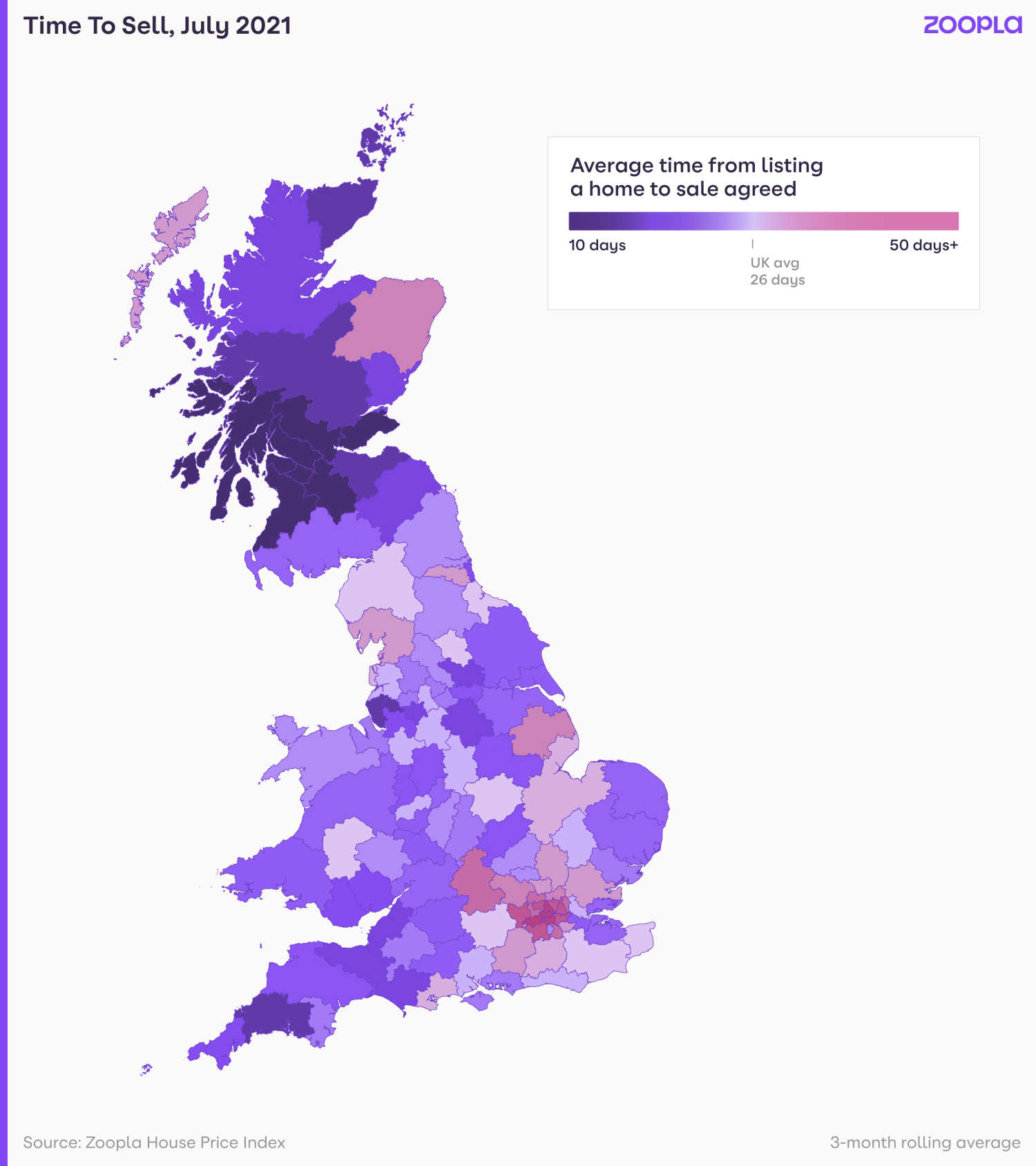

The pace of property sales is also accelerating, with homes taking an average of just 26 days to sell, almost half the 49 days they took in 2019.

Scroll down to read more from our House Price Index report and what it could mean for you.

What’s happening to house prices?

The average UK home increased in value by 6% in the year to the end of July, driven by a high volume of buyers and limited housing stock available.

The price rise of 6% is more than double the 2.3% rate of annual growth recorded to July 2020 last year. An average property in the UK now costs £234,000.

Regions with lower starting house prices on average have seen the highest increases.

Wales is leading the way with growth of 9.4%, followed by Northern Ireland at 9% and the North West at 7.9%.

Price rises above the national average can be seen at city level, too.

In Liverpool, where the average property costs £136,721, house prices have gone up 9.4% during the past year.

House prices in Manchester and Belfast have increased 7.7% and 7.5% respectively over the same 12 month period.

Meanwhile, property prices in London have edged ahead by just 2.5%, although the rate of growth has increased from 1.9% in March.

How busy is the housing market?

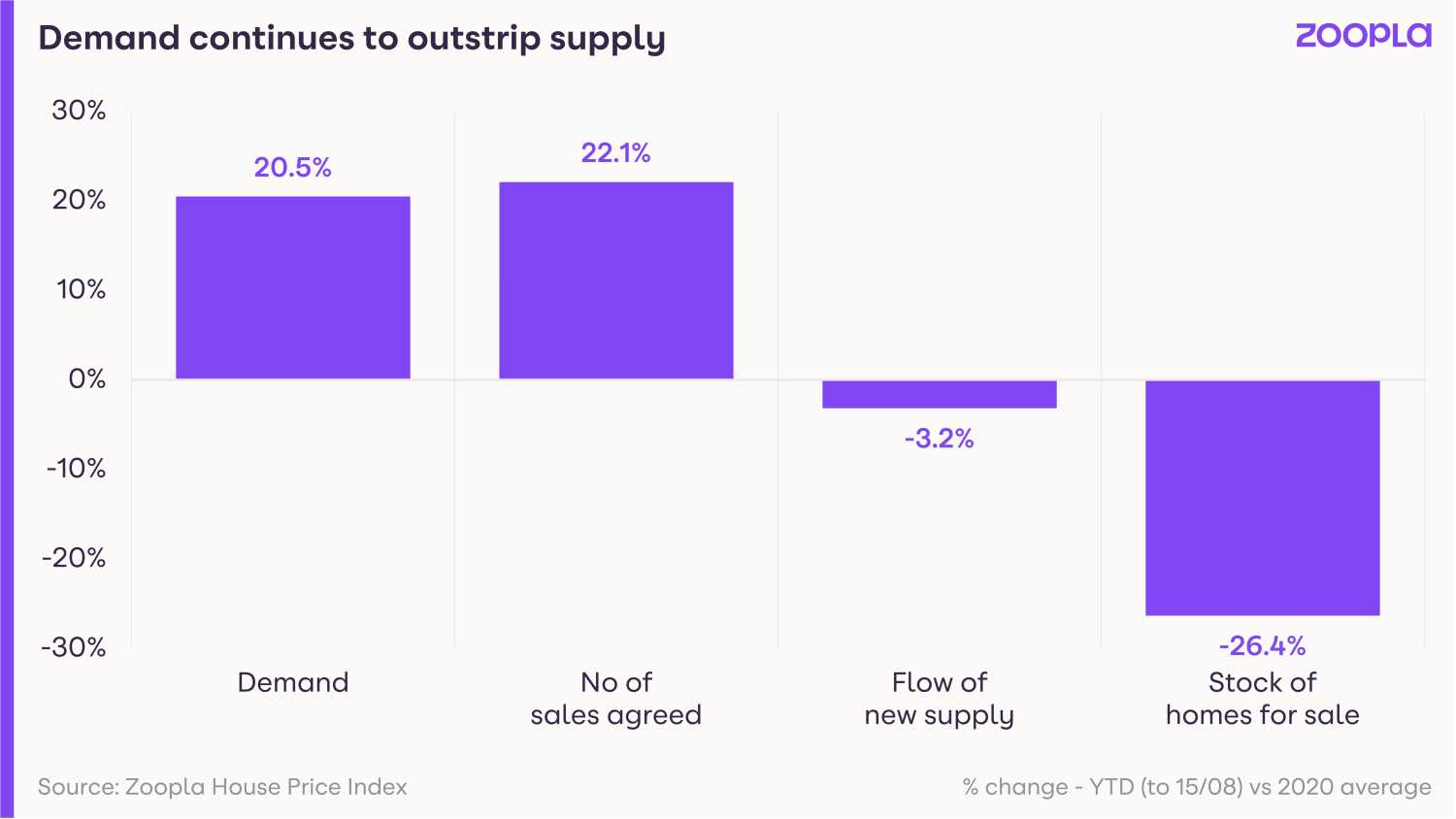

Demand from buyers is going up, with the number of people looking to purchase a home 20.5% higher than the average for 2020.

Competition among buyers intensified due to the stamp duty holiday, which saved buyers up to £15,000 in taxes if they completed before the end of June.

As a result, there was a 40% increase in sales in the 12 months to the end of June.

The high level of buying interest is being met by a deficit of homes for sale.

The number of homes for sale is a quarter lower than the average for last year, and a third lower than levels seen in 2018 and 2019.

What do buyers want?

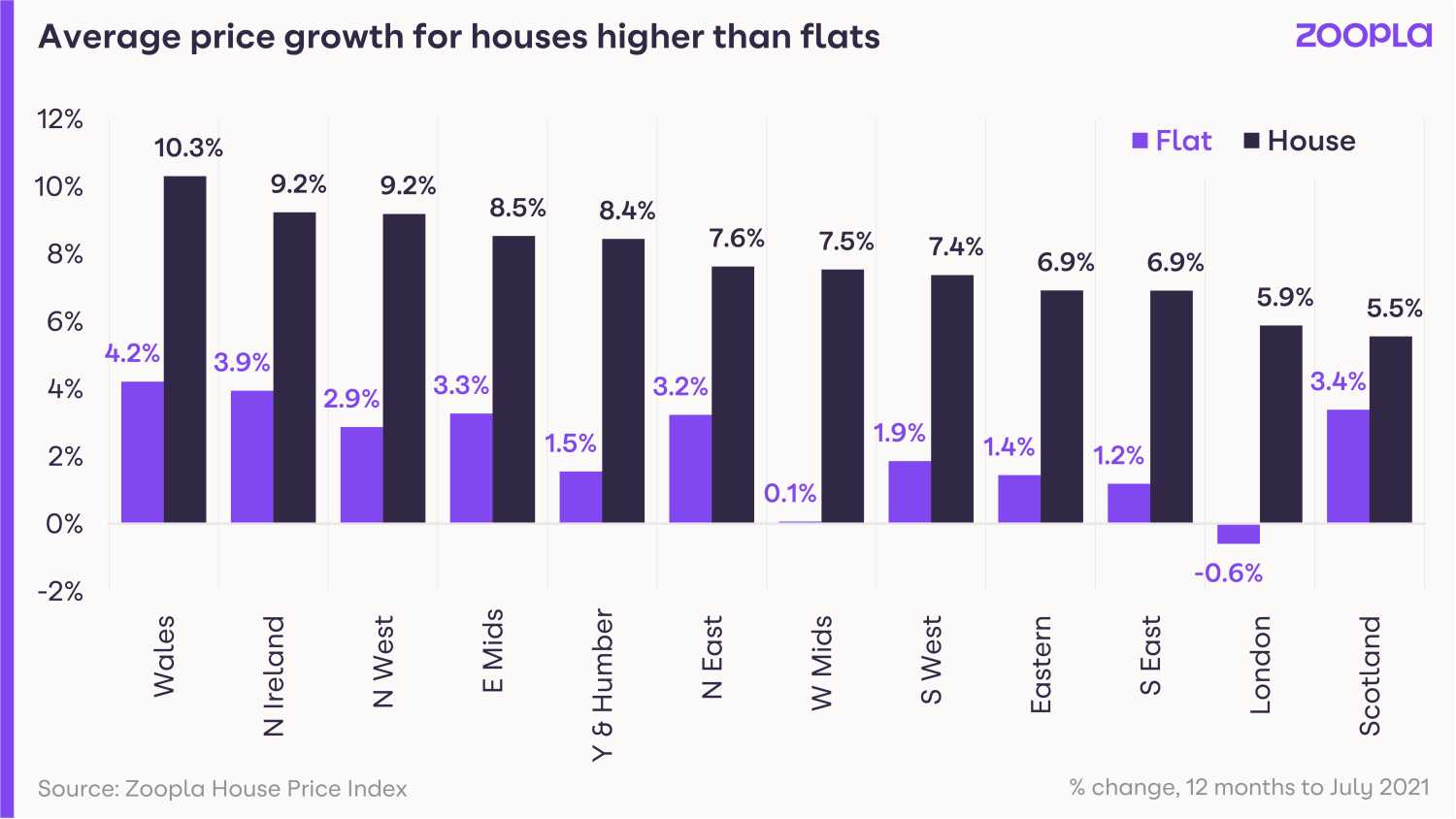

Houses rather than flats are in high demand at the moment, and there is a lack of houses for sale to meet this demand.

Houses of 3 or 4-bedrooms and homes priced up to £350,000 are where the biggest shortfall can be seen.

This shortage is reflected in the price of houses which jumped by 7.6% during the past year, compared with flats which went up just 1.2%.

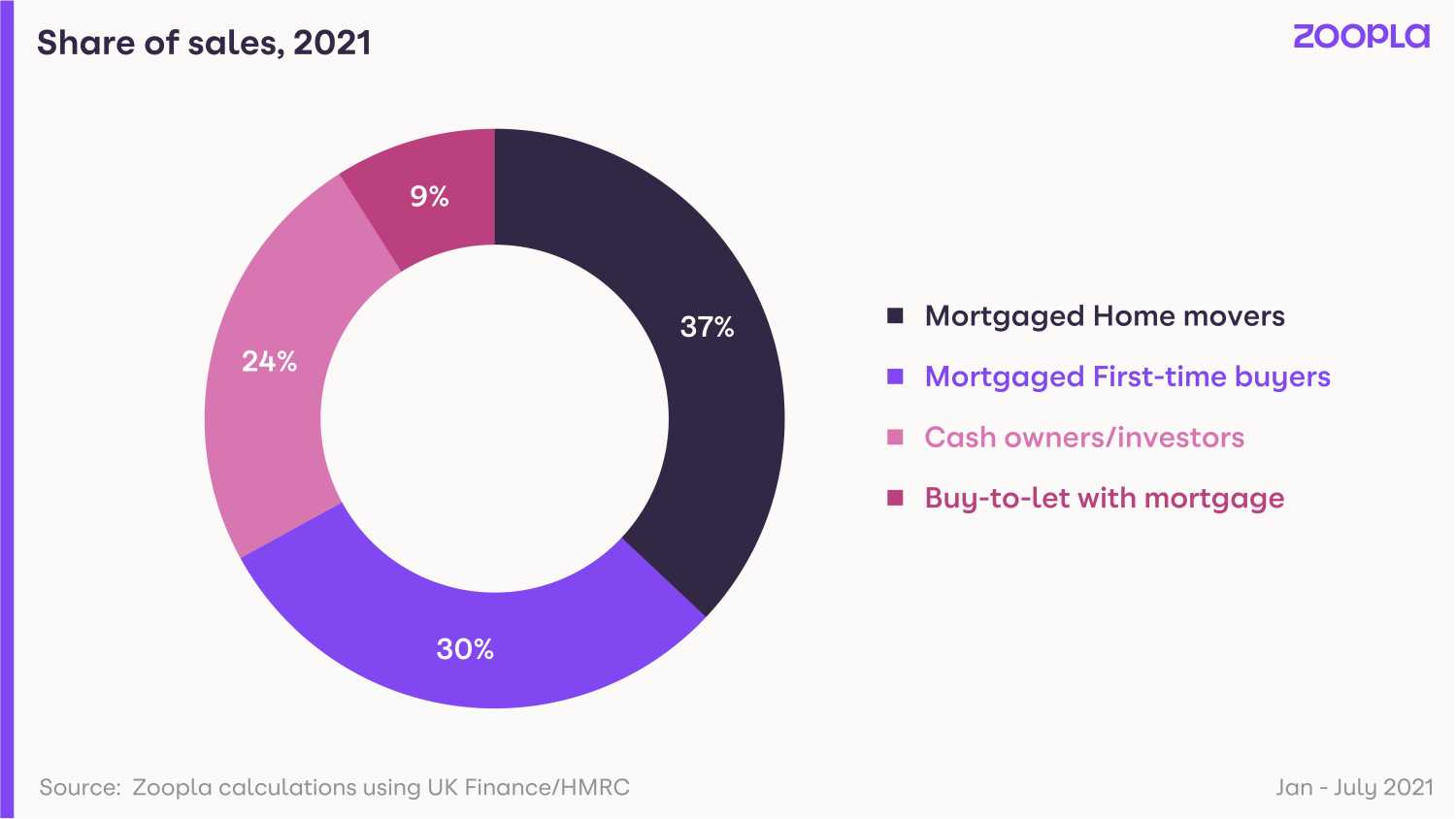

Typically a homemover both buys and sells, creating demand and supply.

The current shortage is not being helped by increased activity among first-time buyers and property investors, who do not have a home to sell.

What could a sellers' market mean for you?

First-time buyers

You might have struggled to get a mortgage during the first 12 months of the pandemic when mortgage lenders tightened their belts.

Lately, banks and mortgage lenders have become more willing to offer mortgages to buyers with smaller deposits.

First-time buyers account for 30% of all sales so far this year.

If you are looking to purchase your first home, you can expect fierce competition from others also trying to get on to the property ladder.

The good news is first-time buyers will continue to be exempt from stamp duty on the first £300,000 of a home up to £500,000.

The exemption will still be available to you even once the tapered stamp duty holiday ends at the end of September.

This means you can afford to wait until the market cools down a bit.

Home-movers

If you have a family home to sell you are in prime position to get top price for it.

Use My Home to find out how much your existing property is likely to be worth.

You can also expect a quick sale under current market conditions.

Finding your next home is likely to be trickier due to the shortage of homes for sale and intense competition from other buyers.

If you can sell your current home and delay purchasing your next one, it may be worth it.

Otherwise, you may want to find your next home before listing your current one.

What will happen in the market next?

The shortage of homes for sale is expected to continue well into 2022.

The impact of the stamp duty holiday should work its way through the market within the next 12 months.

Levels of homes for sale should begin to gradually recover once other government measures related to the pandemic have been withdrawn.

The slowdown caused by lack of supply is expected to impact prices, with annual growth expected to ease back from 6%, to between 4% and 5%.

Gráinne Gilmore, our head of research, said: “The post-pandemic ‘reassessment of home’, with households deciding to change how and where they live, has further to run, especially as office-based workers receive confirmation about flexible working, allowing more leeway to live further from the office.

“The lack of supply, especially for family houses, means the market will start to naturally slow during the rest of this year and into next year, as buyers hold on for more stock to become available before making a move.

“As we move into 2022, there will be a strong start to the year in line with seasonal trends, but after that, a return to more usual levels of activity among first-time buyers, the effect of the ending of the stamp duty holiday, and some buyers waiting for more stock to become available will result in a slow repairing of stock levels through the first half.”